Life Insurance in and around Payson

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

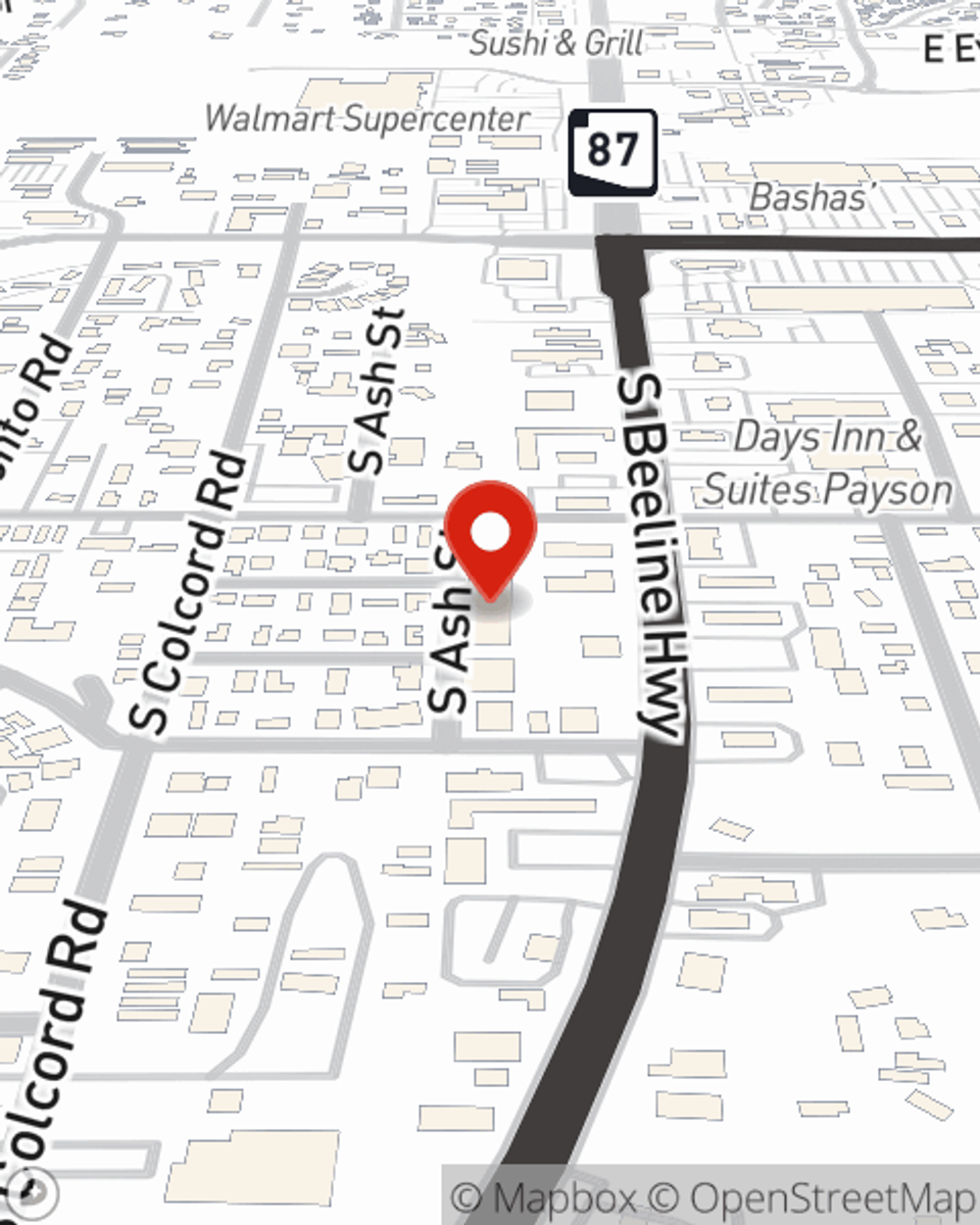

- 418 S Beeline Hwy

- Gila County

- Payson

- Pine

- Strawberry

- Tonto Basin

- Happy Jack

- Heber-Overgaard

Protect Those You Love Most

People obtain life insurance for several different reasons, but the main purpose is always the same: to secure the financial future for your loved ones after you pass away.

Life goes on. State Farm can help cover it

What are you waiting for?

Wondering If You're Too Young For Life Insurance?

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you pick should correspond with your current and future needs. Then you can consider the cost of a policy, which is determined by how old you are and the age you are now. Other factors that may be considered include body weight and gender. State Farm Agent Matt Crespin can walk you through all these options and can help you determine what type of policy is appropriate.

To find out how State Farm can help protect your loved ones, call or email Matt Crespin's office today!

Have More Questions About Life Insurance?

Call Matt at (928) 474-2590 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Matt Crespin

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.